(Original article posted around last week of April 2011)

My 4yr old son wakes up so early now, I have no choice but to bring him with me when I go for early morning walks. He’s into numbers so you can ask him the price of Unleaded Gasoline and he can tell you to two places of the decimal point. Maybe in a while we’ll do a “connect-the-dots” of the prices, so he can see the trend. Cool huh!

My 4yr old son wakes up so early now, I have no choice but to bring him with me when I go for early morning walks. He’s into numbers so you can ask him the price of Unleaded Gasoline and he can tell you to two places of the decimal point. Maybe in a while we’ll do a “connect-the-dots” of the prices, so he can see the trend. Cool huh!

I’m sure you don’t need to do “connect-the-dots” to know gas prices has been going up! $109 was the price of Oil a while ago, been going up for a while now, think that filling up at the gas station is going to be a slippery situation? You’re probably right! Can you help it? No. Can you do something to protect yourself? Yes as a matter of fact, you can!

This has happened before, for sure you’d remember… 2008? (Before the Global Financial Crisis). We were paying up tp $1.70 per liter at the pump (it’s now at $1.47 with $30 or so to the High). It’s happening again and it’s about time you “make money from people who make money from you”! Just a step back, the reasons floated around at that time:

1. increased demand from growing economies of China and India — the new kids in the block in consumption

2. supply problems in places where they are sourced (e.g. Nigerian rebels attacking oil facilities)

3. hurricanes (Oil rigs needing to be evacuated)

4. declining value of the US Dollar (the US Dollar goes down, Oil prices go up)

5. some authoritarian rulers going crazy thrown in to the mix! (Venezuelan leader “surprise” privatization of Oil companies)

The unfortunate situation in Japan also fuelled the recent rise in Oil prices. With Nuclear energy being seen as unattractive option, there is more demand for Oil and gas resources. The BP Oil spill that happened in the United States few months back also restricted the production plans of companies. The simmering discontent in the Middle East which produce much of the world’s supply triggers uncertainty ( at the very least). On the demand side, more countries joining the big league as far as consumption is concerned : South Korea, Indonesia, Brazil, Russia and a host of Asian, Latin American and African countries as well.

All these point to higher prices, with the hysterical High reaching $145 back then. So before things get more painful at the gas station, look at investing in Oil and Energy related companies. Maybe you can calculate your holdings (the number of shares) such that you have enough to pay for the gas and more. Say every month you expect to pay $100 more for gas, if you have 500 shares it only need to move by 23cents for you to get that value to offset high gas prices. If it moves 50c per month, you are definitely ahead (50c x 500 shares = 250 per month). Gas pain becomes Gas gain.

Or be prepared to get walking everywhere… decidedly healthy and good for the environment too, if you can do it.

Thanks to Via Uno Shoes

———————————–

UPDATE 12 MAY 2011

OIL had dropped by $10 to below $100 but the gas prices at the pump didn’t budge as much! Follow my discussion with Forbes blogs contributor Agustino Fontevecchia on the reasons why!

—-

Updated 25 May 2011

After Oil prices plunged to high ’90s, I got into my oil stock again, thought it could not go much further down due to demand. Found this article where the US Federal Reserve official share my thoughts on Oil Trends.

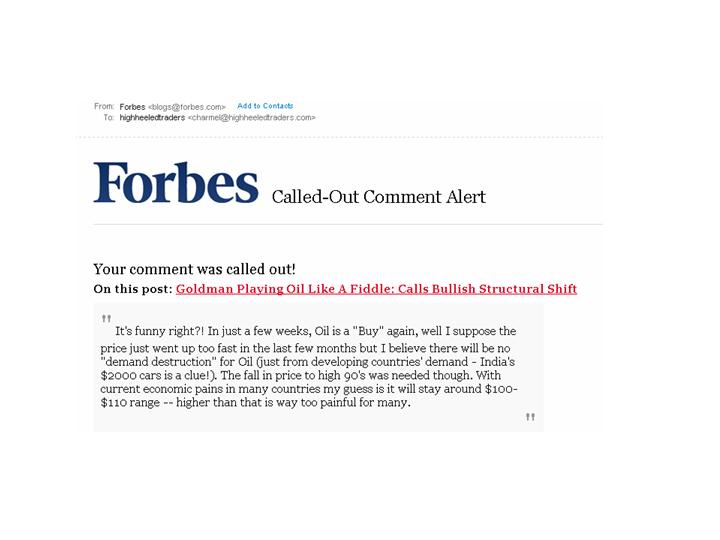

And also a new Forbes blog article about the Goldman recommendation for Oil by Mr. Fontevecchia, commented on it and got Called -Out!

My comments on Oil Trends published in Forbes.com

http://blogs.forbes.com/afontevecchia/2011/04/08/dont-expect-consumer-resilience-to-rising-gas-prices-to-last