Another dark day in the markets, with US market’s DOW down 160+ points and oil following the dive past $100 to 98.54.

— supposedly because of weak jobs growth and that slow burn in the Europe crisis.

Here’s the news from Bloomberg:

http://www.bloomberg.com/news/2012-05-04/asian-stocks-drop-for-second-day-won-weakens-kiwi-rises.html

How am I looking at this? For those who have been following this blog for a while, you’d know I don’t really cling to predictions. Stating the facts however, I did say when the Iran crisis blew out, sometime in February I said it could go to $115 — which didn’t happen — and when talks restarted over the nuclear cha-cha — well, prices softened. BUT, I position for any kind of possibility from the “predictions” having believed that there is NO certainty at all in success of the Iran talks (they have a history of starting and restarting talks – yeah, the cha-cha dancing). So yes, I’d just take a position that can be profitable either way, I loaded up on the shares and put hedged it (meaning protect) — in Options trading this could be done in several ways, (call, puts etc) so for many of you who are following me, this is a good time as any to learn more about it. I discuss it in my book or (Start Here). For those who don’t have exchanges trading in Options and only trading on stocks, it’s time to really understand the Oil and interconnectedness of the markets, not just relying on charts, as well as growth projections of the company and some quick reminders:

1. be prudent with positions

2. set stops that you can really tolerate but also considering the market volatility

3. if planning to “Buy on Dips” – take note of the support level, it could still move down, and wait for confirmation

We are entering a rather slippery phase – I can’t tell how long the decline will be. It might go back up tomorrow – sort of bargain hunting, who knows – best to position size wisely.

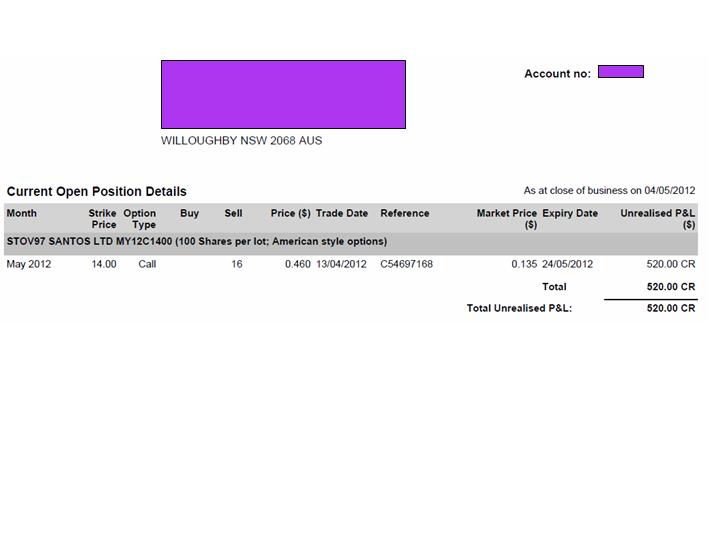

As for my trade, because I have a Covered Call on the stock that Covered Call is profitable (now 13.5 cents from .46 cents or profit of 32.25 cents) and I could buy back the call to close the transaction with profit of 300% or 3 times what I risked, and with the stock I have another chance to write another Covered Call and hedge with other strategies. Here’s the statement: