This weekend, it’s not a trading day, I planned to do some book promotion, but I can’t help opening the finance sites and read the news — no, gobbled up the news! With eye-popping headlines that DOW jumps to a record high 15000 points with jobs strengthening in the US. (Article here) I felt I just had to read all about it and share the good news! From the economic news, there’s also the article of Berkshire’s 51% profit – for the first quarter. I’m like, WOW! Many of you would know Warren Buffett – dubbed the greatest investor of all time, and “has highlighted the prospects for the world’s largest economy, where most of Berkshire’s operations are based.” This is really comforting, because Buffett’s businesses are those what you’d find as common needs or what people normally buy “banking, consumer products (like Coke, Sear’s Candies) hauls freight, generates electricity, sells insurance and manufactures building supplies from bricks to paint”. So I think he covers the two things that are important and “leading indicators” to US recovery :

> Housing

> Consumer Confidence

Springtime bloomtime in the US right now, so here’s hoping that it would spread around the world. Since US imports much from China, Japan, and other developing nations as suppliers of raw materials this is where the growth could be sustained. (Oil – no, they have a lot of domestic supply right now). But risks from higher taxes and less public spending is there… so enjoy the highs while it lasts.]

Here’s the Bloomberg article.

So back to what I’ve mentioned in the last post… will this May be different? Maybe, maybe not. As investors it is important for us to go with the flow. What we have seen as “historical weakness” may change, at least until European debt issues come forward again. In the case of the Philippines, the danger is the rising Pesos vs the USD,. Foreign fund managers report their performance in USD, so there is a foreign exchange risk there. We tackle this in the Retirement Investing webinar in depth. My advise is to keep monitoring and take action to preserve your profits as per your sytem’s exit and profit-taking beliefs.

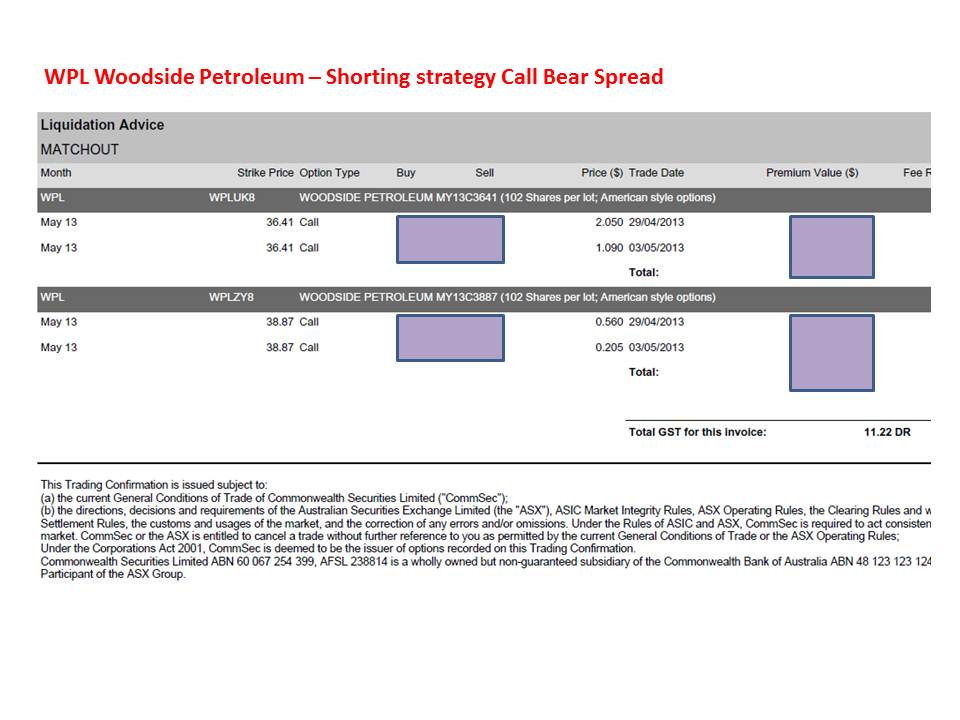

Me? I reported yesterday that I closed my “short” position (projection that prices will go down) on WPL (Woodside Petroleum) , one of the other reasons I sold it too is that I felt the price could still retrace (to the higher level above $37 which it did briefly yesterday) given the positive signs in the US. Plus an expected rate cut from the Australian central bank (Reserve Bank of Australia) due to the weakening economy, from weak mining sector, from weak China, from weak EU (anyone else?!).

Ready for next week’s move up 🙂 Here’s the liquidation advice on my latest trade :

WPLUK8

– Sold to Open at 2.05

– Bought to Close at 1.09

TOTAL = .96

WPLZY8

– Bought to Open at .56

– Sold to Close at .205

– Total =.355

SPREAD Value at close = .605