Following yesterday’s market action, I noticed that FB had a mostly up day while the wider market was wallowing in the red, it was a tricky situation, I had to control my “fear” as I watched the price march higher and higher while all 3 major indices was red (as it had done the previous days of high volatility and selloff). Please click the chart to show full picture.

What is happening is the D word “divergence” which, if you’ve been studying a stock for long is a good indicator of the market – usually of a reversal of a trend. Divergence is simply monitoring what the market is doing and seeing if the asset / stock is performing in sync with the market – if not, it is diverging. I did say last Friday that it was the BEST time for bargain-hunting didn’t I! I teach this in my workshops, and the next ones are here.

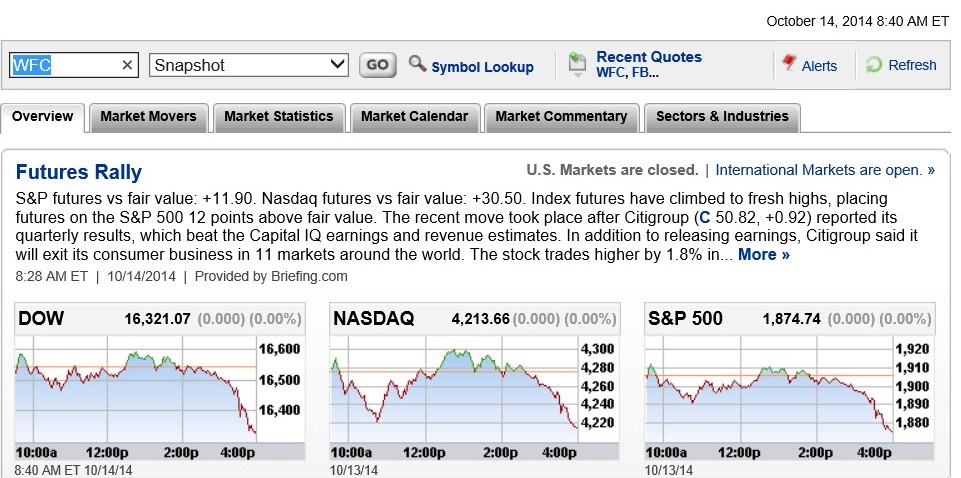

So following my post early Friday and Monday opened strongly and you could have gotten good profits with volatility-based exit strategies, and I also pointed out the Tuesday Earnings Extravaganza that could push up the market from its lows and I can see FB at pre-market pushing up more than $1 already and US futures rallying on the strong earnings growth from Citibank and Johnson and Johnson. Other banks JPM and WFC both reported good earnings, so, what are we selling about again?

Well, FB with its fast-growth and earnings record dares to be different.