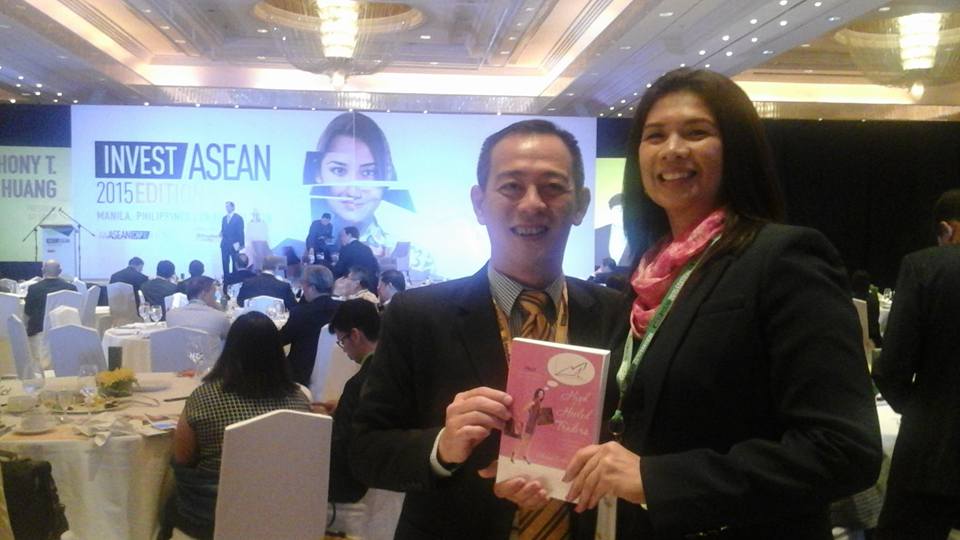

Attended the Invest ASEAN 2015 Manila leg organized by Maybank and it was a fantastic event that reinforced what I believe all along – that women and Southeast Asian countries with its growing middle class, consumer-driven economies and educated working women are the consumers to focus on, and that will create tremendous growth for investors for years to come. With the stockmarket rout happening globally, we are well-poised to take advantage of undervalued companies that are already reaping benefits of being resident in ASEAN countries. (ASEAN – Association of Southeast Asian Nations composed of Philippines, Thailand, Brunei, Malaysia, Indonesia, Singapore, Vietnam and neighboring Myanmar, Laos, Cambodia)

Check out the research from MasterCard / Maybank that makes the Invest ASEAN campaign all the more exciting!

Back to the stockmarket rout, the Chinese stockmarket again shed 7.6% “Government intervention has dropped substantially,” Michelle Leung, the chief executive officer at Xingtai Capital in Hong Kong, said in e-mailed comments on Tuesday. “The reform-minded camp within the government that favors letting the market do its work seems to be driving decision making right now.” I just said this in my blog post yesterday, that the Chinese government (or any govt) can’t prop up a dropping overvalued stockmarket (see thy wisdom!) and we can see there are Asian indices rebounding – possibly from all the value buys that can be found — these markets which have a consumer economy and less dependent on the weakened manufacturing / export industry — and dare I say, less government meddling!

Chinese Stocks article :

http://www.bloomberg.com/news/articles/2015-08-25/chinese-stock-index-futures-slump-as-market-rout-seen-worsening