China is the single reason why stockmarkets are falling. Yes, even if the US economy is growing, and EU economies are benefitting from record stimulus. I talk about it all the time in my Low-Risk High-Reward Investing workshop. There are market movers that we have to know about. See, the world is interconnected like never before. Money travels in the click of a button and without borders. Let me give you a backgrounder — Chinese government officials have been on a mission to restructure the economy and “spreading the wealth” through social programs, so they say, the 10% per year growth is gone and will be replaced by a target of 7%. One would think, that it would follow that there would be less demand for commodities like iron ore, copper, coal, oil, that benefitted from the government-funded infrastructure projects. Some say the corruption crackdown which made luxury goods “a must” are hurting consumer buying. Also, China’s exports are being sent to countries that have been in recession or slow growth > Japan, EU, United States (which, even this year had a negative quarter!). However, China’s stockmarket was rallying until June this year, fuelled by debt and perhaps the new investors’ enthusiasm for stock investment given that real estate, the more traditional investment hit a wall, and this created another bubble which has been unravelling since. So if you want to know why the markets have been falling – let’s go back to what I’ve just said and hinted last few blog posts — there was a disconnect and maybe the natural or market forces are in the process of rebalancing. Although Chinese government is fighting this by propping up the already expensive stockmarket. Go figure.

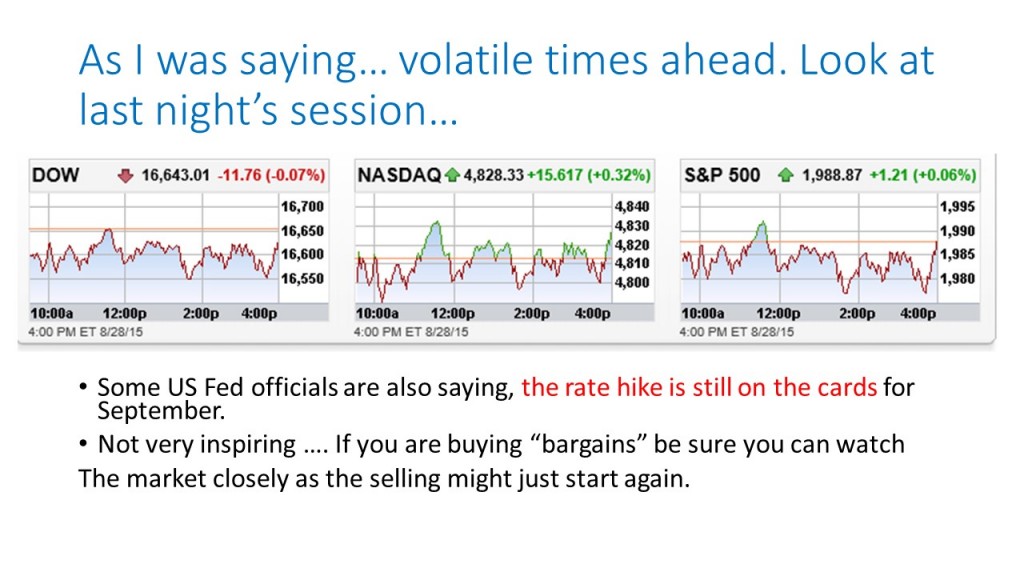

So last night, we got the rate cut. I won’t blame investors if they get into investments and ride “good news” then get the hell out for fear of further slowdown. So as mentioned in my Facebook page HighHeeledTraders.com

the growth or slowdown in China is not yet fully understood. The rate cut was a mere 25 percent. Too little, too late and frankly, with the problems they are facing, not enough.

So people are asking, which countries are least affected by China and are experiencing high growth? Major markets like India, Philippines, Thailand who have limited / least reliance on commodity exports to China’s manufacturing industry, have consumer-driven economies are key. Add to that, little to no geopolitical issues (so Turkey will not make it to this list as it is very close to the Syria-ISIS hotbed)

I posted a video yesterday here about the areas where you could invest your hard-earned money and an article from Bloomberg appearing today (here) echoing my claim on where the safest (and best) investment destinations are because they are not dependent on China and are growing at the top rates in the world.

http://www.bloomberg.com/news/articles/2015-08-25/safest-emerging-stocks-in-markets-with-least-trade-ties-to-china

And if you want to know “Is it time to buy” or as a long-term investor with holdings in the red, is it time to cut losses and wait to buy at the bottom – here’s my webinar for you!

Title: Is it Time to Invest or Will the Market Slide Again?

Description: Bargain hunters are happy seeing stock prices fall, but is it time to buy again or will the market slide again? This webinar will help you determine the risks in the current market, and start you off to creating a Low-Risk High-Reward Investment Strategy.

Date & Time: Thu, Aug 27th, 2015 at 8:00 pm SGT

Registration

Please register for the above meeting by visiting this link: http://highheeledtraders.enterthemeeting.com/m/PMRC6YUR

Once you have registered, we will send you the information you need to join the webinar.

https://www.facebook.com/charmel.delossantosmarcial/videos/10153418670569792/?l=1830595368612364610

—————-

Charmel is a full-time tradermom and author of a stocktrading book for women (that men also enjoy!) “High Heeled Traders” helping individual investors like you achieve your life goals with their investments.