I have been told to post an article about the first things you should know about trading, so as the song goes “Let’s start from the very beginning… a very good place to start!” Perhaps we hear news report about whether the market went up or down, there was a takeover of a company and the share price went up, the price of the USD relative to the local currency, the price of gold, oil…. you “hear” about investing or trading but you don’t really know, it’s like a disease hehehe

I guess it is in a way related since when you have a “disease” , especially a bad one, you can’t work to earn a living and that’s basically, where investing comes in. Also in our old age, we “retire” and don’t expect to work, so apart from potentially receiving “retirement benefits” or a pension from the government (in most countries), people need to invest and have their money work for them. Investing is like having a (girl ) cow for milk and baby cows. 🙂

We live in these times where the prospect of retirement is scary, governments are bleeding from the Global Financial Crisis (GFC) and pensions are in danger of being cut further . My 80-something neighbour say pension payments are not enough even now (and she doesn’t even pay rent / loan as she lives in her own house). We help her change her light bulbs so she doesn’t have to pay $60 for each service call. Every dollar needs to be stretched.

So what do people do? Invest in real estate? Ooops bad example! Well it used to be a good idea, as people need houses to live in and it appreciates in value over time. But even during the good times — how many times can one buy a house to invest in? Once a year? Probably not. Anyway, many countries are still in a messy situation due to real estate bought with easy credit fueling a boom that has since gone bad. Let’s not even go there. Don’t get me wrong, I also invest in real estate, however, investments perform well according to the prevailing market. It’s like sandals being more popular during summer … can you imagine wearing boots during summer? Maybe … but you need a horse to get away with it. 🙂

______________________________________________________________________________

A lot of careful thought needed- – You don’t just jump into investing. It pays to educate yourself. Read, go to seminars and talk to people, analyse and be critical. After gathering all this information and realizing I don’t want to risk too much — I decided to make sure the investment should have :

Protection

Income

Growth

I call this PIG Investing. This way the investment performs in good or bad times and it lasts.

We can think of this PIG investing in the same light as the “Little Black Dress ” — usually simple straight dress that works on it’s own for evening wear just match with fancy accessories, or a scarf for different looks or worn with a jacket for more conservative or business wear. LBDs are versatile , long-lasting and allow you to have “much” with “little”. So remember your LBD when looking for PIG investing 🙂

__________________________________________________________________________________

One of the most successful investors in the world Warren Buffett ( Billionaire and consistently ranked one of the wealthiest in the world by Forbes magazine) said ”The basic ideas of investing are to look at stocks as business, use the market’s fluctuations to your advantage, and seek a margin of safety. “

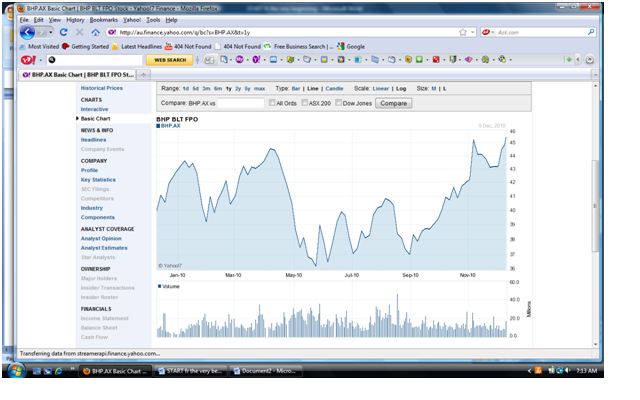

It’s because of the “market fluctuation” – the prices moving up and down that people do Trading . Trading is simply buying and selling. Buy Low, and Sell High. Or Sell High and Buy Low (this is allowed in some markets). Look at this picture and check the ups and downs.

_______________________________________________________________________________________________

If you were only “investing” you would be doing a “buy and hold” strategy which is to hang on to the stock for “a long time” (supposedly as long as you are not losing too much money on it otherwise you should sell for a small loss). Looking at the picture , say at the start of the year, you bought the stock at $40 and it is now $45. You made $5 per share. Sweet.

If Trading however, you need to set up Trading Rules to capture profits. The following are rules that I use in actual trading (made it very simple here just) to show you Trading versus Investing.

SIMPLE TRADING RULES

ENTRY – you will only ever Open trade when there is a Confirmation to your desired direction

STOP LOSS (or “Stop”) you give your trade room to move, and you are willing to lose or Risk $1 (we’ll call Risk as “R” so we will have 1R ), if price moves $1 below your entry price, you get out to “limit” or “stop your loss”

EXIT –you take profit with a target 3 times what you are willing to risk, so with $1 , you want a profit of at least 3R or $3

1) At start of the year in January, you expect price to move up and bought the stock at $40.

a) your Stop is $39

b) the price went up to $43.50,

c) it started to go down so you sold at 43.20

d) for profit of = $ 3.20

2) Say around February, you bought again at $40

a) your Stop is $39

b ) the price went up to $44

c) It started to go down so you sold at $ 43.50

d) For profit of $ 3.50

3) Around May, you were waiting for another chance to buy, the price kept going down and so it is getting cheap, you couldn’t help yourself so you bought again at $38 without Confirmation (violating your Entry rule)

a) your Stop was $37, but because you thought it couldn’t go lower you did not get out right away

b) you got out at $36

c) sold for a Loss of $ 2

4) Around June, you were waiting for another chance to buy, the price had gone down and so it is looking really cheap, but now you waited for a move up, you bought again at $37,

a) your stop is $36, which is the lowest price for the year so far so you decided to hang on for a while

b ) the price went up to $45,

c) it started to go down, so you sold for $44

d) For a profit of $ 7

Altogether for Trading, the results are :

Profit $3.20 + $3.50 + $7 = 13.7

Less Loss of $ 2

TOTAL of 11.70

So looking at Investing profit of $5 versus Trading profit of $11.70, Trading profit is 134% more and that’s just on the Upward direction. (You could take opportunities to profit with moves going Down). Trading takes a lot of self-control though, if you notice, not following the “Confirmation Rule” and “Stop Loss” created the Loss. Rules rules!

You can also apply the same mindset of Protection, Income and Growth for your money in stockmarket by buying stocks of big companies, then trade with a protection strategy and let grow and with dividends for income. Trading can give you more opportunities and if you do it well, you can have extra money or you don’t have to wait until 65 to retire.

And to those asking “what’s the hurry”?, as I was writing this, Mark Zuckerberg (founder of Facebook, who is a billionaire at 26 years old) pledged to donate his wealth to charity, “People wait until late in their career to give back. But why wait when there is so much to be done?”