Have you been seeing the indexes trotting along in what seems to be the “Santa Claus Rally”?

Yeah, ever since last week, the indexes have been in a jolly good mood, even though the US cheering of US Fed lasted only for 5 seconds. Anyway, it did resume as it seems people’s top of mind awareness is hope and goodwill and positivity so, enjoy the uptrend!

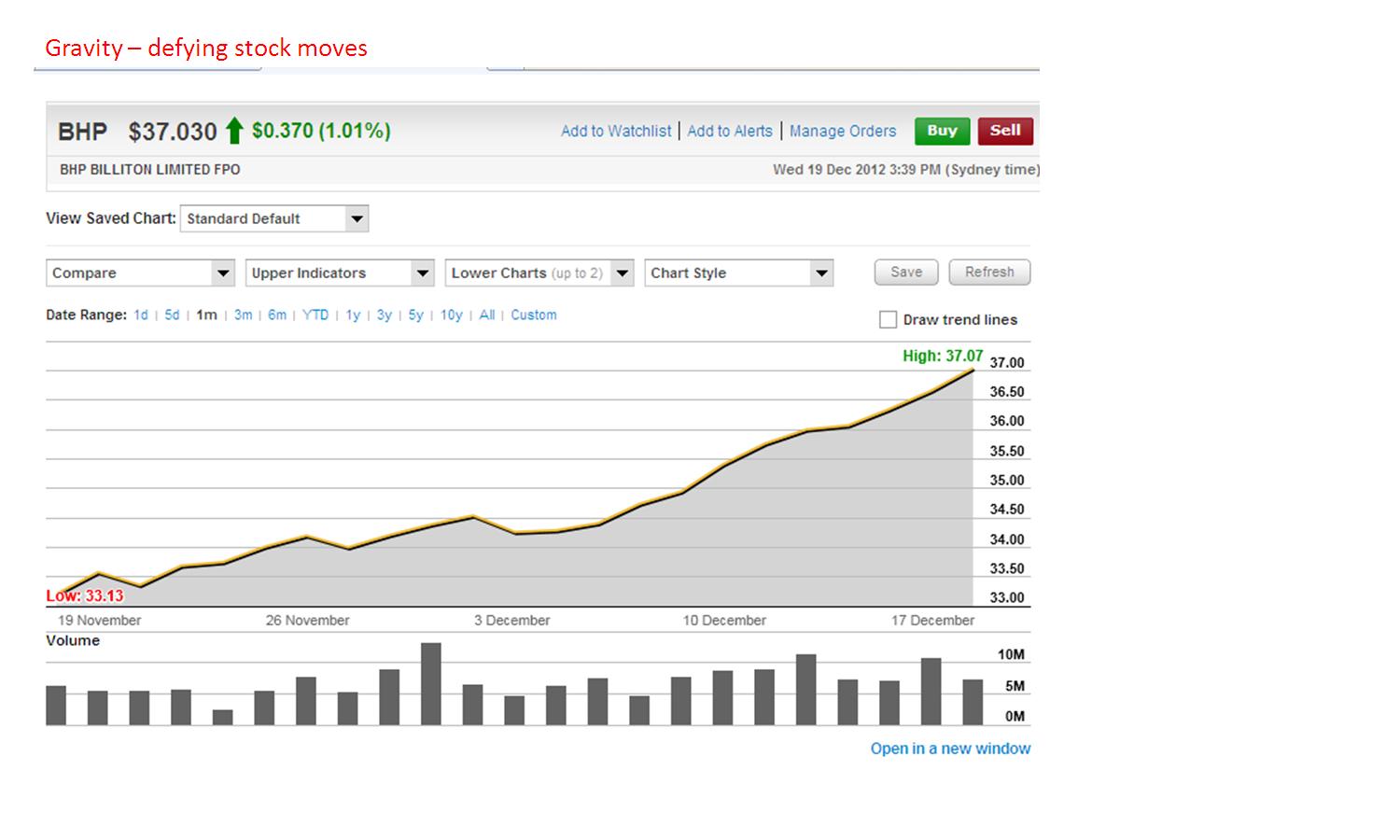

I’ve been watching a new stock I want to trade, and this baby is going up steadily. It is BHP which is a mining stock, the biggest miner in the world! Ahhhh I can almost hear your sigh of disbelief! Mining stocks have been badly affected by the debt / economic storms — yes they are. However, this stock seems to be a very popular holding among the Aussie investors. It’s been defying gravity or “diverging” from the ups and downs and sideways move going on with the great majority of stocks. Now I’m not buying this stock just because it is going up now, I am buying it because it matches well the trading concepts that I use and that’s a departure from the usual Technical Analysis and Fundamental Analysis used in stock selection.

For me it is all about the movement of the stock and how well I understand the way it moves. How it follows the trading concept/s that I like and that’s how I think of ideas to lower my risk. Are we together? OK let me go back to a few months ago, I mentioned that mining stocks were out of favor because of the economic uncertainties, and possibly mining stocks were a “contrarian buy” (read Modern Conveniences ). The low risk idea then is to considering getting into the stock when it is really cheap because everybody else doesn’t want them. But as always, you have to have idea of the conditions that will get it back in favor, because if not, there is no point to holding on to them. OK so now what could possibly get mining stocks in favor? For one, China’s once-a-decade leadership change has been decided which can lead to new policies being pursued. Any guesses for what they want to do? They want to get richer and richer, of course. That could mean more development initiative at the whole expanse of China, just like the last decade. Some people say the “superboom” is gone, but I think even without the “superboom” the need for resources is still there.

And so it looks like BHP investors feel the same way.

Now there is also another reason of its upward trend — with Christmas season, there isn’t a lot of decision-making and company reporting going on so in the absence of “bad” finance news, people can feel positive and feel confident enough to invest. There is a “seasonality” element to the upward climb. We just have to be aware howerver, that this season will fade. So do factor that in your plans.

Not all mining stocks are moving the same though, so go and study how they move, maybe they are not “value buys” but are mere speculative plays with growth prospects but poor production, revenue and too much debt. Not all mining stocks are created equal.

Santa got BHP in the Nice list and has brought it with him to spread holiday cheer.