US Market rallies 308 points, will your market follow this rally? Study the correlation of the markets which will give you an advantage.

http://www.bloomberg.com/news/2013-01-02/u-s-stock-index-futures-rally-as-fiscal-cliff-averted.html

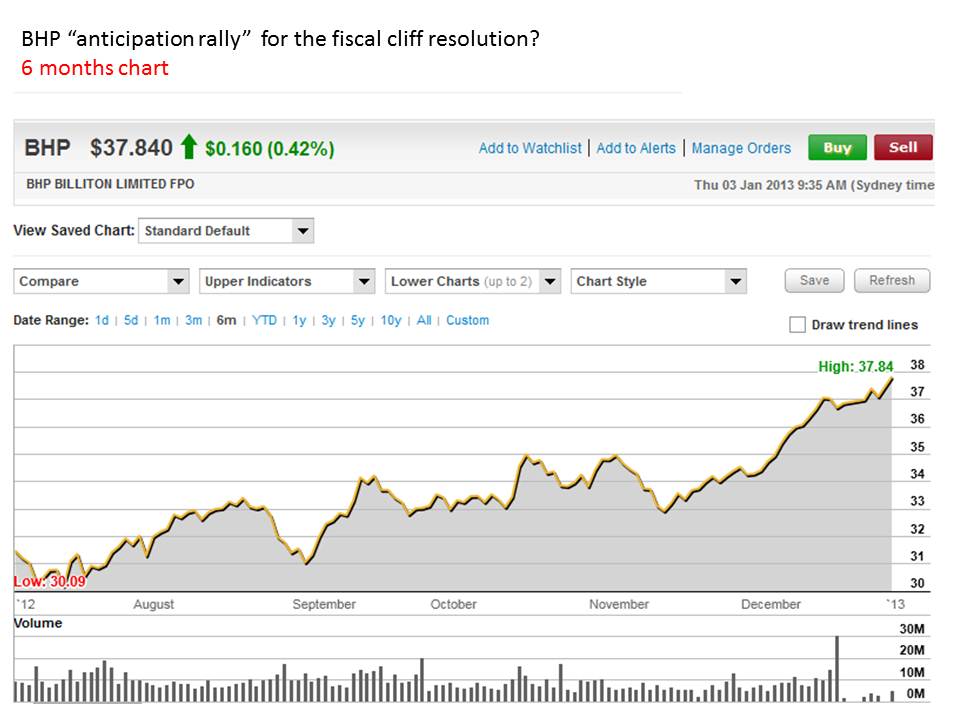

The question that need to be asked also, is how long will this rally last. We waited and waited and waited for the result ever since Obama was reelected. That was 1 1/2 months of uncertainty with a slight tendency to positive territory as the negotiations were closely watched. Now this is where the trading concept you are following and understanding of stocks will be really helpful as you make your move. Has your stock followed the sideways pattern leading to this “fiscal cliff” or did it rally in anticipation?

I have been studying another stock to add to the the one I am using now with STO which had been moving lazily. (And is still on holiday mood, only closing 1 point up yesterday!)

We can look at two trading concepts here:

1. Trend Following

BHP had shown a steady upward move since August when the EU crisis bottomed out – for the year at least 🙂 So for the last 6 months it had the makings of a good Trend following stock. Meaning, it follows a trend which has been going up. The big picture for this stock which is a mining stock blue chip company is also looking positive now that the China and US leadership has been decided. So if the stock moves up with the US rally and then retrace after a few days, there is a good chance it will resume it’s upward move given the new spending / growth policies that will be implemented.

That’s the “positive side”. On the other hand, we can look at it from another trading concept

2. Band Trading (or range trading)

BHP’s High early in 2012 was around $38-39 even (the top range/resistance), then dipped when the EU debt crisis raged on to as low as below $33. So this stock has been going up in the last six months. As it stands at $37.80 level, it may have limited upside left if you think about the rise that it already had anticipating the fiscal cliff resolution. Diverging from the market behaviour with most stocks moving sideways. It has been breaking weekly / monthly / quarterly resistance levels and that rally may fade.

With two opposing points of view, what direction will you trade ? If you ask me, I don’t care much to join the market “rally”. I just take the one with low-risk and high reward result. I have been doing more Band Trading than Trend Following so it is likely that I will trade with this concept ensuring that I calculate my Risk vs Reward first. So I am looking for this stock to move up and as it goes up with lower volatility today and next few days, I will short it.

Now you know I haven’t been out shopping despite the post Christmas Sales. I don’t like crowds 🙂