Maybe I could put the title “Etiquette for Moneyed People”. Yesterday, I went shopping by myself, and it’s a fabulous experience, I can walk and certainly make decisions faster, (my children are lovely, but time-consuming LOL). As I was walking towards a luxury retailer, I noticed a line of people starting to form and an irate lady 3rd in the line was demanding to be let in at once. She was saying, “we spend a lot of money in there” and the guard seemed to say there are still customers inside. The irate lady was angrier this time saying “It’s not like I’m a one-time only customer” … and angrily walked away. (Leaving others to shop in peace I must say!)

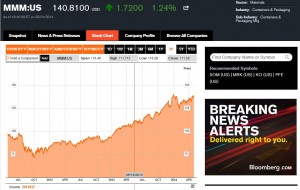

I was thinking what’s the lesson in here … first, one should behave, whether we have lots of money or not, with politeness and respect for others. I’m sure the luxury retailer wouldn’t want to turn away a customer, but maybe they want a pleasant, “uncrowded” shopping experience for the benefit of all customers. You wouldn’t want to be jostling for space or the salesperson’s attention would you? That’s why I always prefer early morning opening times to go shopping as a rule. It’s the best way to get the best results. There is a lesson here also in stock investing “get in early”. This is especially true for “trend followers” – learn to spot a trend and also which stocks would follow the trend. This is why IPOs or “Initial Public Offerings” are some of the fastest and most profitable investments. If you invest in a company IPO which is in a strong sector, historically there are lots of winners (until the “euphoria” dies but that is another post!). Examples of that are Google and Facebook — which are being battered right now, so late investors are getting an unpleasant ride, but think, Google and Facebook have already been down before and if you think their business are still set to grow, then it’s a good move to invest. Other investing styles like “value investors” would see this time as potential buying spree for companies that have been ignored but are undervalued — those with solid earnings and pays dividends. In terms of sector, I’d be looking at Finance / Banking sector which stands to benefit from a growing economy, strengthening jobs and consumer confidence. I am particularly eyeing Wells Fargo and credit card companies like Mastercard. BUT don’t dive in right now,,, I discuss my exact procedure so that we get in at a low-risk high-reward strategy at my bootcamp. So don’t miss this low-risk high-reward investments and register here!

Interestingly, I came across the article “Why Do Investors Make Bad Choices” today — more on money behaving badly I think! Very interesting article that may give you an insight on how you behave as an investor. Though I love (and highly recommend) Dr. Van Tharp’s very detailed study on the “biases” on his book “Trade Your Way to Financial Freedom” much more on this one.

The author of the article, in my opinion made these investment mistakes because

1. He did not invest with overall life objectives, thus, he sold his holdings wanting to be “safe” and yet, the number one rule in allocating capital for investing, is that it should be money you can afford to lose. One should be able to Risk to get a Reward. No pain no gain. Get it?

2. He did not have a system, much less a business plan. (There is a difference? Oh yesss) The system tells you when you should get in, how much to risk, when to get out to protect capital with your stop or get out with most profit (exit). The business plan involves a comprehensive study of your business environment (the market), the investing strategy you could employ in the prevailing market, and of course the mental states and discipline one should have in this business!

AND… as a mom, having lost all of my capital and now financially free, I am happy to be able to help you with the system and business plan components to get you started on your merry way to investing! Save time, money and hair! No need for trial and error…. Join my forthcoming events here! and invest without the stress!

Bloomberg View Article “Why Do Investors Make Bad Choices”.