It’s going to be an interesting week ahead. Breaking News : a terrorist attack in China, Russia invades Ukraine, and there’s the Red Carpet for the Oscars 🙂 that might be enough to further confuse if not dampen the already soaking-wet economic prospects of the US and the world. I’m also wary it’s already tail-end of earnings season, with the US GDP also reported lower (here), so, my sentiment is on the cautionary side.

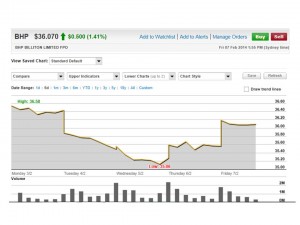

I mean, what’s left to cheer about?! My short position on BHP. (Tadaaa — entered at the last 5 minutes on Friday — 38.43 on BHP a Put option with strike price of 37.50 expiring March – tell you the code later!) Like what I previously posted, today is the day — the stock goes ex-Dividend (sched here), so watch out guys, this is a magic trick — the stock price will drop today! And I get this question a lot “what does “ex-dividend mean” so here’s the official blurb from the Australian Securities Exchange website :

” Ex dividend date

The ex dividend date occurs four business days before the company’s Record Date. To be entitled to a dividend a shareholder must have purchased the shares before the ex dividend date. If you purchase shares on or after that date, the previous owner of the shares (and not you) is entitled to the dividend.

A company’s share price may move up as the ex dividend date approaches and then fall after the ex dividend date.

—

Happy now? Note the number of days (prior to Record Date (the 4 business days they are talking about above) may be different to the market you are trading.

And, let’s see how the world reacts to the “geopolitical crisis” courtesy of Russia for a few days. I’m hoping it won’t be too bad, Russia just hosted and should still enjoy basking on the glow of the Winter Olympics (and spent billions on this PR machine) so methinks they are just wanting a little more “attention”. Anyway, hope you’ve got protection on the downside, invested in oil 🙂 or otherwise prepared emotionally for this wild ride.