The US Market rallied today to an unbelievable 490 points! I heard of a “Santa Claus rally”, and while I don’t have a clear idea of why there would be one, this 490 points today could be it! I mean, just last week we’ve got the European Union problems on credit flooding the ,markets with uncertainty, I doubt there would be good news of any sort but hey, I’m not one to complain, I’ll take any gift thrown my way.

Last week, the stock I am watching was at a very low point. It was temptingly low, and I thought of adding positions. However, I was still very busy polishing the eBook, and the EU problems still persisting so I didn’t feel prepared enough to trade a new position.

But let me share the thought that so tempted me – you know I’m a band trader right. I watch the highs and lows of the prices. Last week is at the low point of the price range, so I am watching an “exhaustion” or a slowing in direction of the price moves that may indicate the move is nearly over and could reverse. A common example in trading is the ebb and flow of ocean waves. On practical terms, something looks very cheap to some people and they’d go and buy it, pushing the prices back up. On the other hand, prices could also go out of hand and something could be “overpriced” with people wanting to sell at that point to take profits driving the prices back down. It’s just how the world works.

If you still want to make sense of it, I can share that these may be due to human and macro-economic forces at work. (Can’t take credit for these ideas, check out “Safe Strategies for Financial Freedom” by Dr. Van Tharp).

1. People are saying that with the Black Friday / start of shopping season, there is pent-up demand. People may have been very careful in spending most of the year, but it’s the holiday / Christmas season so, purse strings are loosened a little bit. It’s like trying to lose weight / watch what you eat but then eventually, you give in to temptation. People are out shopping, which is good for the economy. Just saying.

2. Mi casa su casa – that’s Spanish darlings. The House of Europe is in trouble,,, and the Chinese think they are or will be too. So before the worst happens, the Chinese are out to do something to help out. At least themselves. Their economy is export-oriented, meaning they make money selling things to other countries like EU countries. (Wonder who does not get things Made in China). And knowing they can’t depend on selling a lot than they used to to others, they are also loosening up purse strings at home. They’ve just relaxed regulations about bank’s reserve requirements (so they can lend to people), who can go shopping i.e. “stimulate demand” at home.

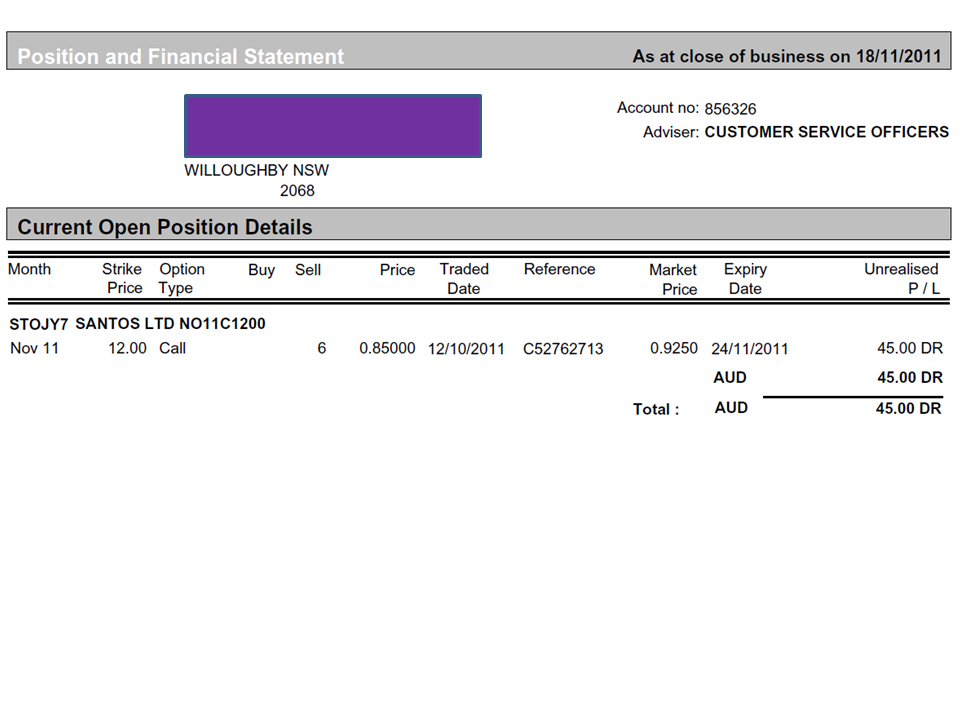

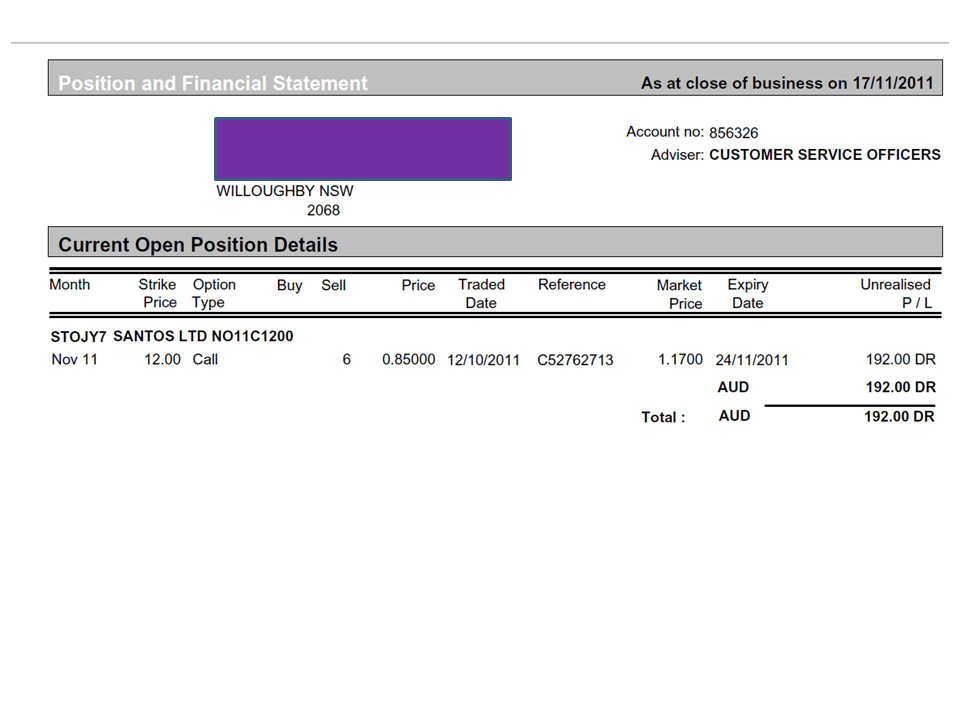

How to trade these conditions? Well, the last one I did was a covered call that I bought back. My shares are therefore following the ebb and flow of the market. I thought of the covered call strategy again out of fear that more sharp drops can happen, but thought, it has gone down too much in the time frame and the 3R profit opportunity is not there, I didn’t want to risk it. My stock STO has gone up 3 days now and today the volatility is getting muted, which is signalling to me that the ride down might happen soon.

But until it actually moves down, I’m just watching.

Let the Santa Claus Rally begin!