I finally had 3 hours of “me” time to go for a hair appointment yesterday. This week was a fresh break from what I’ve been doing the past months. Instead of crunching down on the book, I was able to actually get some spring cleaning done, go for walks and catch up on tax paperwork with beauty rest-on-demand in between. Lovely. Which is just as well because the shares I am holding for active trading has recovered nicely from the falls in price and I, myself, am “recovering from the book” and “ready to rhumba” – get into position for a trade and get the trading income flowing again (and still have a life!)

I was waiting for an opportunity for the share price on STO to move up because I bought them at about 14.50 early this year and did not put a protective stategy in place (was too busy that time which caused me to squirm when the market dropped sometime in the last 3 months). Anyway, I thought that the Big Picture (e.g. government moves particularly by European Union and US Fed) will and eventually did, calm the world markets / and get my shares on STO into more realistic values so I hang on to it (my stop by the way was 20% – wide enough I thought, but I “overrode” it given the strong government motive to support the markets). Let’s just say I “rode rough waves” and survived, but I’m not doing that again!

MONDAY

So at the start of this week STO’s price was at 12.25 and the chart for the preceding week showed an up trend. With the volatile nature of the market, I thought a good trade might be found. I was doing my trading procedure (to be revealed in the book/ebook).

TUESDAY

Price still moved up but within a lower range (20-30 cents ), so I waited some more, it went up to around 12.60 (previous high) that day, but weakened to 12.45. I continued to wait for the opportunity.

WEDNESDAY

US Market provided a weak lead, so I got ready to look for entry point.

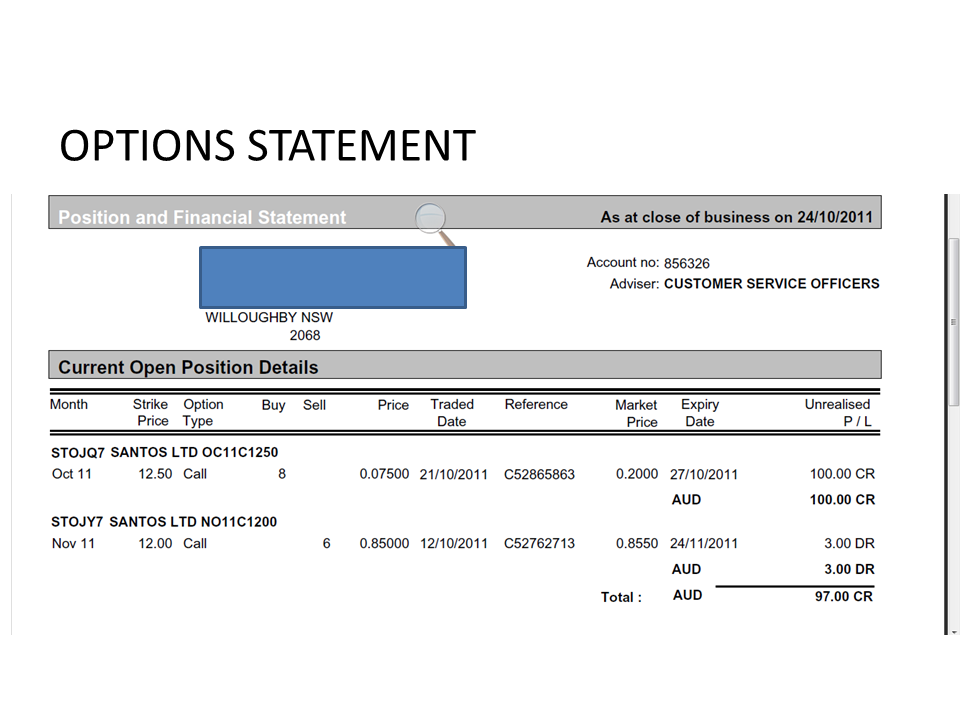

I’m going “short” or putting a strategy to profit from fall in price. Since I am holding shares, I can do a Covered Call strategy in Options. (You can review Options here). With a move down to confirm my expected direction, I sold option with 12.00 strike price expiring in Nov, receiving 85 cents. My breakeven is 12.85. My 1R risk, which I’ve predetermined (from Position Sizing – my current size is $200) is 15cents so I am targeting 3R profit of 45 cents. With the 85 cents I received, that profit target is covered, however I will incur a loss should the price move up past 12.85. I then have to be on alert about this breakeven point so as not to incur a loss on the shares.

THURSDAY

I had errands on. I had my “protective strategy” with that covered call in place so I can go about my day while the market does whatever it wants to do. I got my son and toddler on a “fun ride” on the red bus to the city and did some paperwork at the consulate, then got ice cream treats on the way back. Checking the phone, I was surprised the whole Australian market had a steep fall by mid day. Apparently, the EU will have meetings this weekend and Asian markets fell reacting to news that there is a wide disagreement about the bailout fund, so, I went about my day — secretly happy.

My son wanted to ride the train, so we went to walk to the heart of the city – but made a wrong turn. Which is just as well because I spotted an “Italian Shoe Importer Outlet” – which you know, I had to check out! Hehehe. Anyway, 20 minutes passed and I came out empty-handed, they didn’t have my size on the ones I wanted. Proceeding out though, we were made to go past an adjoining store which had a ramp (for my toddler’s ride) — they have other Italian imports –branded handbags, jeans, sunglasses. From when I remembered that my sunglasses just broke and need to be replaced! (Shades are a must here – UV from the sun is too strong harming the eyes plus you’d have to squint all the time and get wrinkles!) So anyway, I snagged a bargain in the process that I can claim from insurance (sunglasses with prescription lens). In case you’re wondering my kids were quietly waiting (babysitting courtesy of the Iphone apps hahaha).

Attempting to make "Bande" Cashew Nuts

Oh, STO moved lower that day to 12.07 making my trade profitable. It did get me excited but had to hold off closing the trade and let the market move in my direction. I went to an Asian grocery to get my mind off profit-taking mode that could cut short my profitable run. I got a bag of cashew nuts and palm sugar to experiment making “bande”, a delicacy I enjoyed at a friend’s. Nutty and sugary, guilty pleasures they are called.

FRIDAY

US Market had a swinging session, but ended up. And it’s Friday, which almost always lead to weakening of prices for the shares I hold (possibly due to short term positions that are closed to avoid overnight risks from US – this is my observation ) so again, secretly happy. My shares went up in the early session, which eventually fell towards lunchtime. By then, the price of STO has been forming a floor on the 12.07 level, and I thought, I might just put in a new position. In the economic / Big Picture front, the EU was going to have a big meeting on the weekend (they’ve been yakking about a bailout fund which according to some news is going to be a “convincing” 1.3 Trillion fund), so potentially, the market will react strongly afterwards – either up or down. At this point. I thought, I’m protected at down moves, but not on the upside.

So, I did my trading procedure which pointed to an opportunity for Long position (profiting from move up).

I picked the Call Option with 12.50 strike price. This cost me 7.5 cents and I bought 800 shares, costing me $60, plus fees (to open) of 37.11 = $97.11. My breakeven price is 12.575 for the shares and 3R profit target is $260

.075 x 800 shares = $60

$60 x 3 = $180

$180 plus fees $80 = $260

$260 / 800 = .325 per share

I chose this to ensure I trade within my current position sizing ($200). This trade will let me profit from the expected strong move up brought about by the EU meeting, but if the market is not happy with the results and lead to falls, my risk is small and tolerable, and my existing covered call trade will be profitable. Also if the share price does not move beyond 12.50 in the near term, I am still exposed on the covered call but, my position sizing will allow me to take another opportunity for further protection as needed.

So here’s the deal:

If price is below 12.50 – ‘covered call’ strategy is profitable

If price is above 12.575 – ‘buy call’ strategy is profitable

Which means either way, the trades are going to be profitable.

So what are you waiting for? Get your guilty pleasure.

Guilty pleasures - photo by AJ Mallari