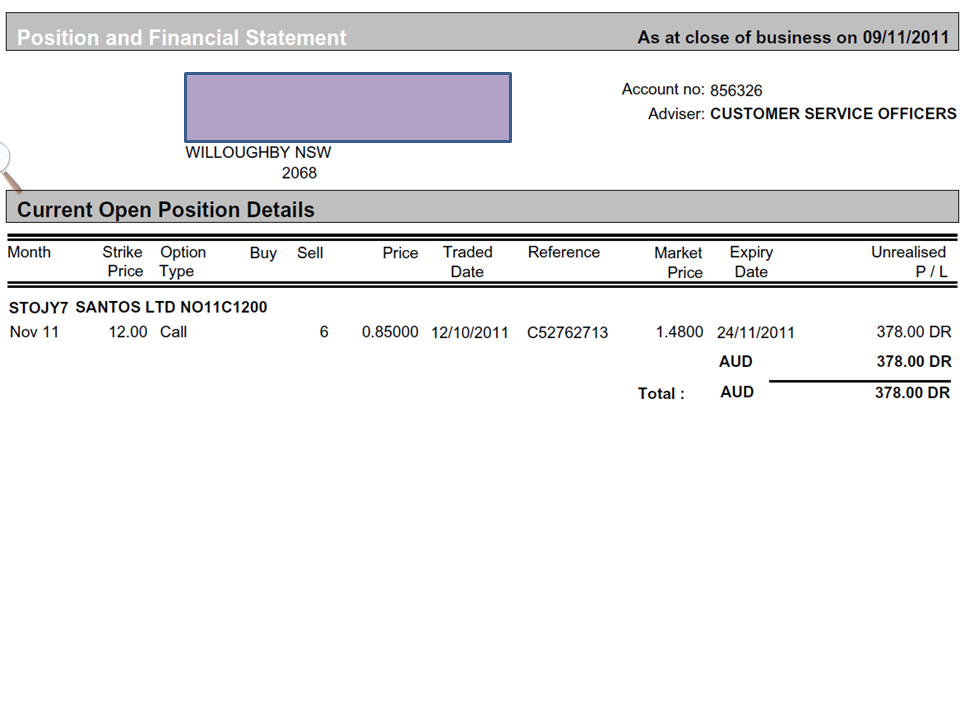

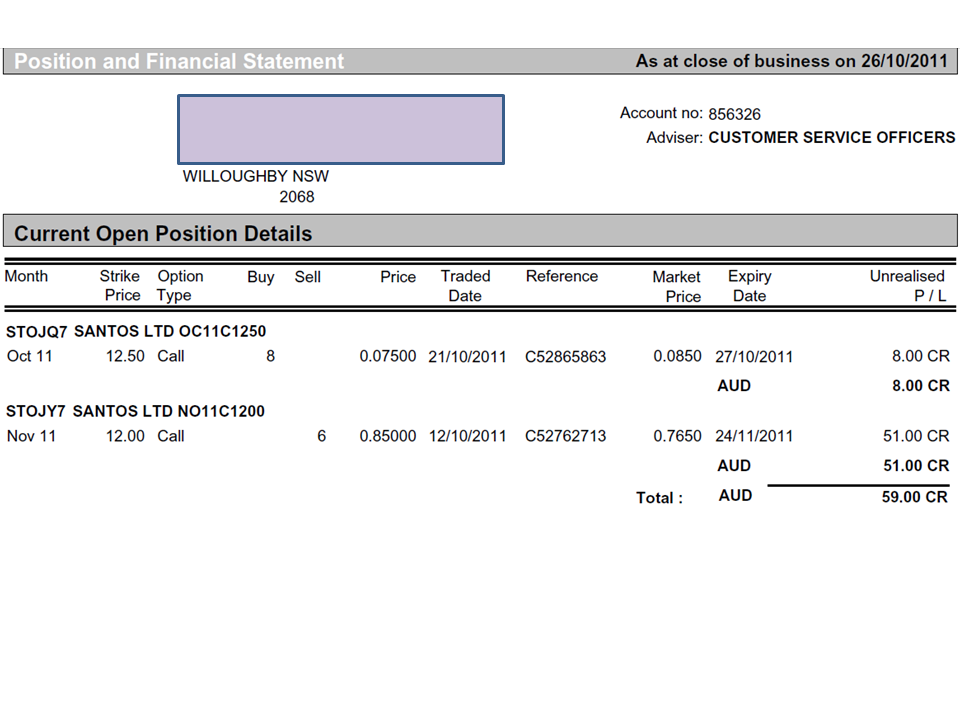

The last days I’ve been staring with disbelief at the market indices (like the DAX, FTSE in European market index and Dow, S&P in the US) seeing that they’ve been climbing up 100+ points even with the raging problem in Greece and Italy where the Euro region is struggling with their debt issues and leadership changes thrown in. I mean it is just so laughable to be buying anything amidst the uncertainty. However, the markets still rose “celebrating” the resignation of Italian PM etc, then there is the fact that my “covered call” is rising in value when I wanted it to go down so I can buy it back cheaper is no laughing matter. I have $378 “floating loss” as of yesterday on that covered call.

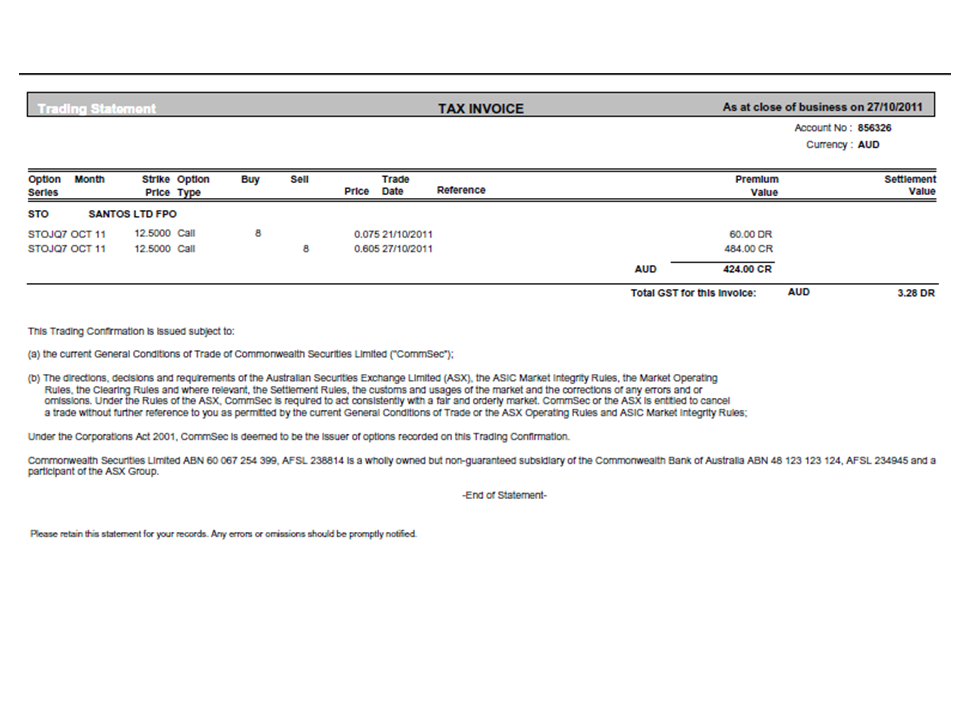

Last Friday, I was in two minds of whether putting a trade to buy back the call or put a new trade, seeing a confirmation for a move up, however, I was measuring the risk and the 3R reward potential is just not there looking at the charts (support and resistance levels) and with Greek drama still unfolding, so in my mind, it was not worth the risk. I did squirm when the price still went up higher 100+ points the next day and the next.

Nevertheless, I believe the Big Picture and market type will lead to a downward move in the market in a few days, and I am looking for an opportunity where I can do another trade with a 3R reward. I said, if the stock finish higher than 13.50 I will put in a short position (to ride the move down) which has 3R profit potential.

Anyway, this morning, as the US Market ended nearly 4% at 389 points, apparently, Italy will not get the same rescue as what Greek is getting (er, hope to get) — and again, I am laughing, in relief this time for my covered call. Read on the market results here.

Today (at least) the real picture is mirrored in the market. This EU debt issue is not yet finished and it will continue to move the market sideways. Enjoy the slide!